Tesla closes at $1,516.80/share, while Ford closes at $6.36 today? Whaat?? A year ago, Tesla was trading at $240/share. Has the stock market turned into a hacked online game?? That puts Tesla at a market cap of $281 Billion. The Big Three combined has a market cap of $82.7B. Tesla is now worth over three times what the Big Three is worth?? Even Elon Musk on May 1st tweeted that at $760.23 Tesla was overpriced. Where is this money coming from?? I hope pension funds aren't going to get wiped out over this when the market crashes.

Results 101 to 125 of 133

-

July-14-20, 05:25 PM #101

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

-

July-14-20, 06:30 PM #102

DetroitYES Member

DetroitYES Member

- Join Date

- Dec 2010

- Posts

- 6,816

Look at it this way

Back when they wanted to ramp up the space program the feds funded silicone valley.

Fast forward the same thing is happing with Musk look at everything his is into,storage mega batteries,solar,hyper rail,space program.

If you look at the technology field and Silicon Valley did not even exist before the feds pumped billions into it first.

So it is speculation based on all the billionaires that Silicon Valley produced in the past,but like I posted before,he has 100s of thousands of technology patents where even if they produced nothing they are worth billions,they really are more RnD with actual tested working models.

They are even doing the electronic highways,once you enter,the highway takes over your car and you just relax.

Watch his interviews sometime,it appears as though he likes his weed.

If you want to have fun,do some day trading with their stock,that is pushing a lot of it.

-

July-14-20, 07:31 PM #103

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 1,355

Out of thin air!

https://wolfstreet.com/wp-content/up...tal-assets.png

-

July-14-20, 09:42 PM #104

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

Elon also broke up his technology patents into separate companies. Tesla doesn't own the private company SpaceX, but Elon owns 54% of SpaceX. SolarCity was another failing company owned by Elon and Elon used his position as CEO of Tesla to bailout his losses to the tune of $2.6Billion in 2016 when Tesla bought it out.

Elon doesn't even believe Telsa's worth half that. Yet, Catherine Wood, CEO of Ark Investment Management is running around CNBC telling everybody it will hit $7,000 and $15,000 by 2024. That's a multi-trillion dollar valuation for a car company and investors are falling for it. Why isn't the SEC stepping in and shutting her down? Elon also shouldn't be allowed to break up his technology patents into separate companies like that because it's hard to tell which technology patents you're buying when you buy Tesla stock.

I can just imagine the carnage when this "tech" bubble bursts.

-

July-14-20, 09:54 PM #105

DetroitYES Member

DetroitYES Member

- Join Date

- Dec 2010

- Posts

- 6,816

They let Enron get away with it until it crashed.

Mrs Wood is going to run around with pump and dump,they probably bought cheap and are going to ride it and it will crash just like the housing market did.

Looking at history there have always been that pump up then the bubble bursts,gas in the seventies,dot com,solar,the housing market etc.

Its too late now but the ones that will make bank or billions are the creators who will know just when to cash out while leaving the late commers holding the bag.

Its no different then,I forgot his name,the one in New York that ran the ponzi for so long,people get greedy looking for high returns and fast money,then get stuck holding the bag.

-

August-21-20, 07:27 AM #106

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

Tesla closed at $2,001.83/share, while Ford closed at $6.84 yesterday? Unbelievable. Tesla stock was trading at $240/share a year ago and now Tesla has a market cap of $371Billion, while the Big 3 combined has a market cap of only $90Billion??

How is this possible when JD Power rates it the most unreliable new car selling in the US in 2020??

Do people even know what they are buying??

https://hypebeast.com/2020/6/tesla-j...20-survey-news

Tesla Rated Least Reliable New Car in the U.S. in 2020

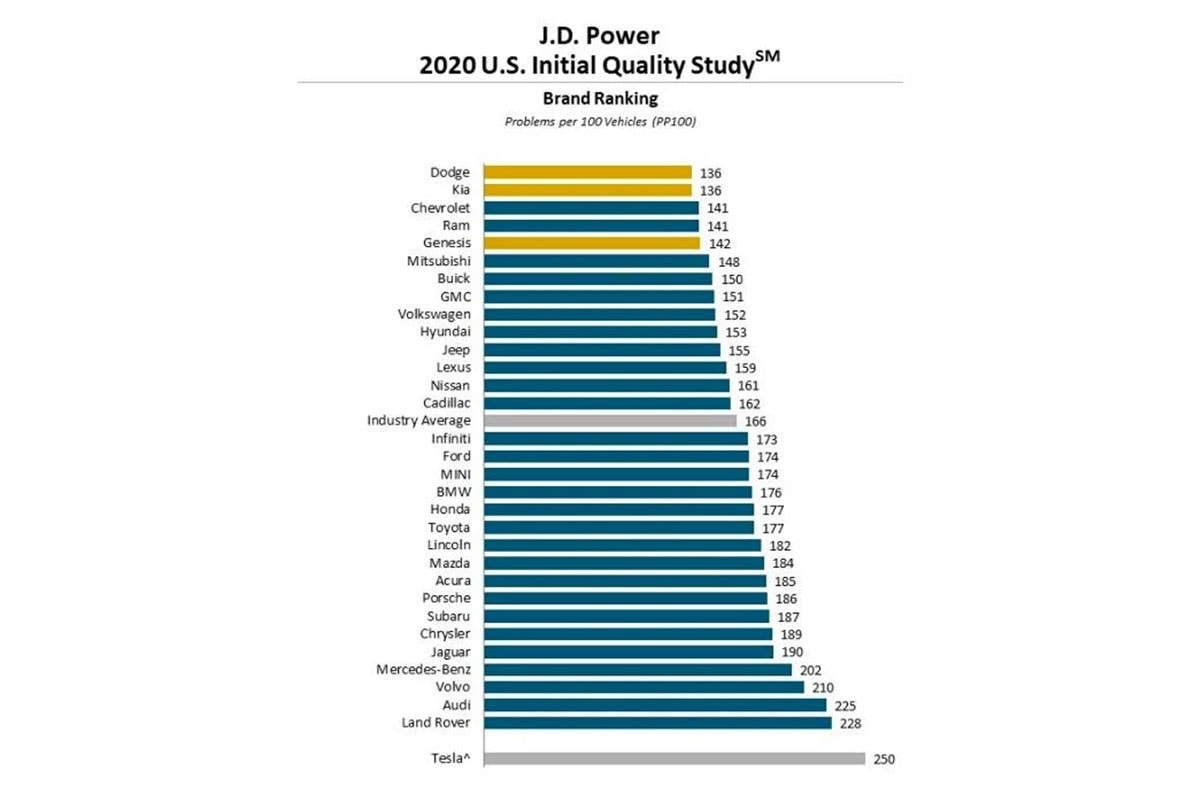

American analytics company J.D. Power has just released its 2020 Initial Quality Report for the auto industry, and Tesla has been rated the least reliable new cars in the U.S.

According to the survey — which looks at the amount of issues owners experience during the first 90 days of purchasing a new car — Tesla recorded a whopping 250 problems per 100 vehicles [[PP100), putting them at the very bottom of the reliability chart. J.D. Power pointed out that the ranking is not official, since Elon Musk‘s company refused to allow the analysts to survey its customers in 15 states where OEM permission is required, president of the automotive division Doug Betts reassured that “we were able to collect a large enough sample of surveys from owners in the other 35 states and, from that base, we calculated Tesla’s score.”

On the other end of the spectrum, Dodge and Kia tied for first place for most reliable, each recording 136 PP100, while Chevrolet and Ram tied for second place at 141 PP100. South Korean manufacturer Genesis followed closely at third place with 142 PP100, while much of the bottom half of the list were full of luxury import brands. Across the entire industry, new cars experienced 1.66 problems in the first 90 days of its purchase, a worrying number which J.D. Power explained may be due to its revamped survey questions this year. It now asks 223 split across nine different categories: features, controls and displayers, interior, exterior, seats, climate, driving experience, infotainment, powertrain, and the newly-added driving assistance.

-

August-21-20, 07:49 AM #107

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

This is the biggest scam of them all, "Back in May, Tesla CEO Elon Musk unlocked the first tranche of his stock options which, at the time, were valued at $706 million USD. Now, Musk is close to unlocking his second tranche which, combined with his first, can be sold at a profit of a staggering $3.5 billion USD. ... Both tranches allow Musk to purchase 1.69 million shares in Tesla at $350.02 USD each, a significant discount from the current stock price of $1,397 USD. ... As CEO of Tesla, Musk takes no salary and is only paid by the options within the agreed pay package. When first announced, Tesla revealed that Musk could theoretically earn as much as $55.8 billion USD" https://hypebeast.com/2020/7/elon-mu...-5-billion-usd

He is only on his first two of 12 tranches in stock options.

$55.8 BILLION USD FOR CEO COMPENSATION IN A PUBLICLY TRADED COMPANY?? GIVE ME A BREAK!

-

August-21-20, 10:17 AM #108

DetroitYES Member

DetroitYES Member

- Join Date

- Apr 2009

- Posts

- 7,055

-

August-21-20, 10:22 AM #109

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2017

- Posts

- 601

-

August-21-20, 11:06 AM #110

DetroitYES Member

DetroitYES Member

- Join Date

- May 2020

- Posts

- 926

Nothing about Tesla seems rational or logical, it's just pure cult insanity. Is China buying their stock or something? It just makes no sense at all.

-

August-21-20, 11:21 AM #111

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 4,532

It seems to be all these millennials who love tech to begin with and started buying individual stocks during the pandemic. It's driven the Nasdaq through the roof but particularly Tesla. The fact that investors are saying GM and Ford should spin off their electric vehicle divisions because these same people might love another "new" electric auto company tells you it's all FOMO and not rational.

-

August-21-20, 11:54 AM #112

DetroitYES Member

DetroitYES Member

- Join Date

- Dec 2017

- Posts

- 253

-

August-21-20, 01:20 PM #113

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

Most of the stock money is coming from institutions funded by pension plans [[ETF funds buy Tesla stock, and pension funds buy the ETFs). If the bubble bursts and Tesla is worth 10% of what it is today, a lot of pension plans will be seriously unfunded, which means another recession or trillion dollar bailout by taxpayers. It should be illegal for pension plans to directly or indirectly invest in Tesla or ETFs.

-

August-21-20, 05:29 PM #114

DetroitYES Member

DetroitYES Member

- Join Date

- Feb 2014

- Posts

- 2,246

How do you expect for anyone to take anything in this post seriously when you can not research a stock or do simple math dave?

Is there ever going to be a time again when people do not spew made up crap to peddle fear and try to pass it off as some kind of fact? Do they not know it makes them look dumb?

TSLA market cap as of today: 362 Billion. No, a billion is not a “trillion”.

Amount of TSLA institutionally owned: 52% or 194 Billion. Those institutions include damn near every growth mutual fund.

Change laws based on made up bullshit... No thanks. That would be stupid policy.

https://www.nasdaq.com/market-activity/stocks/tsla

https://www.nasdaq.com/market-activi...ional-holdings

-

August-21-20, 08:04 PM #115

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 1,355

At a closing price of $2050 per share Tesla now has a market cap of about 380 billion dollars.

So a company that has hemorrhaged billions for years and only recently had a couple profitable quarters [[Barely, and only thanks to selling government credits) is now valued at more than the world's largest retailer [[Walmart). I'd let that sink in for a moment before going long on Tesla at $2050..

Last edited by Johnnny5; August-21-20 at 08:08 PM.

-

August-21-20, 08:17 PM #116

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

There's something seriously wrong with you. Do have some kind of reading comprehension problem or do you just nit pick every single word without putting it into context with my previous posts? Did you not bother to read Post #104 where I pointed out that Catherine Wood, CEO of Ark Investment Management is running around CNBC telling everybody it will hit $7,000 and $15,000 by 2024. Did I make those numbers up? No, obviously not.

Do I have to repeat every point I made in previous posts just so you understand the context and not nitpick every single word? I'm sure that over 99% of the readers understand what I'm saying here except you, but you obviously can't see the forest for the trees.

We're seeing a quick trajectory upwards, which is why Catherine Wood is making that prediction.

You don't think it's gonna go any higher if the SEC doesn't get involved? How much money do you want to bet and loose that it will go much higher? And it's not just me. There's a lot of analysts that are saying that. Just do a simple google search and get your head out of your ...

It's obviously not going to burst today with all the gains its been making today and you know that's not what I meant, but once it hits the multi-trillions like Catherine Woods says, we're headed for a recession when the bubble bursts and guess what? Elon will be laughing at the rest of us with his multi-billion dollar CEO paycheck.

Here's your simple math using Catherine Wood's prediction of $15K a share. We have a $2.73Trillion evaluation by 2024. 52% of $2.73Trillion = $1.42Trillion

Tesla closed today at $2,049.98. It's up another $46 today. $15,000 a share by 2024? It's getting there. Elon just announced a 5 to 1 share split to further solidify these gains.

BTW, Tesla isn't the only tech company with a ridiculous evaluation. There are many others. Amazon has a market cap of $1.65Trillion, yet their 2019 net income was $11.59B. That's a cap rate of almost half of one percent. In comparison, Walmart has a market cap of $373B, yet their 2019 net income was $14.88B, which is a cap rate of 4%. How does Amazon's evaluation make any sense?

And it's institutional funds that got us there. You think we're not headed into a tech bubble burst and crippling taxpayer bailout with the first domino being Tesla?

I strongly believe the government should step in and shut this nonsense down. It's not a stupid policy. Why regulate Enron and many others, right? Have we not learned anything from the past?Last edited by davewindsor; August-21-20 at 10:23 PM.

-

August-21-20, 09:13 PM #117

DetroitYES Member

DetroitYES Member

- Join Date

- May 2020

- Posts

- 926

-

August-22-20, 09:22 AM #118

DetroitYES Member

DetroitYES Member

- Join Date

- Feb 2014

- Posts

- 2,246

I would not buy or drive one myself either. But I do not let my personal preference make investment decisions for me or determine wether or not I think they should exist. Make them here in America, R & D them here and I have no problem.

Obviously it was pretty damn dumb of the state of Michigan to throw walls up against their business model for so long. Tens of billions of dollars in engineering and manufacturing know how was locked out of Michigan when we happen to be good at that stuff.

Stupid ass Michigan prejudices picking winners and losers bite us in our standard of living yet again. Will it ever end?

-

August-22-20, 09:44 AM #119

DetroitYES Member

DetroitYES Member

- Join Date

- Dec 2017

- Posts

- 253

Of course not silly. The comparison was made to state the premise that Tesla has a cult-like following much like Apple does. The thing is many other companies that make hardware actually are better than Apple but consumers buy into the marketing and blindly purchase the next thing the company puts out. Same thing with Tesla. They put out their new-fangled products and despite being ranked very low in reliability or competitors having better options for the price it doesn’t matter. They’ve already cornered the market with their brilliant marketing and “sexy product,” kind of like how Apple does it, and people buy it anyways.

-

August-25-20, 06:39 PM #120

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 6,548

If Tesla is worth more that Ford and GM.. Why the company is not selling more vehicles and promoting ads?

-

August-26-20, 08:50 PM #121

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 8,200

Total duration 20 minutes:

The Future of Driving | Compilation

Self driving cars and self-repairing roads: the future of driving is bright, or at least less aggravating.

-

August-31-20, 04:27 PM #122

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 1,482

-

August-31-20, 04:44 PM #123

DetroitYES Member

DetroitYES Member

- Join Date

- May 2020

- Posts

- 926

This is the car company that broke their own windows during a demo folks.

Literally lied to the faces of the audience and they saw the evidence for themselves but still cheered. A great metaphor for Tesla, utterly insane twilight zone joke. How are none of these people worried about holding the bag?

Wonder if this all ends like Theranos did. Probably not as big of a fraud but still a fraud.

-

August-31-20, 05:00 PM #124

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2012

- Posts

- 8,856

They should do fine after they get the bugs out.

https://www.businessinsider.com/tesl...g-movie-2020-8

-

August-31-20, 05:08 PM #125

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 3,865

I wish someone would give me a simple answer to this:

If I have a Tesla, and wish to drive from my home here in Henderson, NV, to visit family in metro Detroit, how many stops do I have to make, and how long is each stop for? Not counting an overnight in Vega, TX, or Springfield, IL.

Welcome to DetroitYES! Kindly Consider Turning Off Your Ad BlockingX

DetroitYES! is a free service that relies on revenue from ad display [regrettably] and donations. We notice that you are using an ad-blocking program that prevents us from earning revenue during your visit.

Ads are REMOVED for Members who donate to DetroitYES! [You must be logged in for ads to disappear]

Ads are REMOVED for Members who donate to DetroitYES! [You must be logged in for ads to disappear]

DONATE HERE »

And have Ads removed.

And have Ads removed.

Reply With Quote

Reply With Quote

Bookmarks