Results 126 to 145 of 145

-

August-17-16, 06:55 AM #126

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2012

- Posts

- 8,854

-

August-17-16, 06:55 AM #127

DetroitYES Member

DetroitYES Member

- Join Date

- Feb 2010

- Posts

- 3,901

I'm a millennial that voted for Bernie. I'm voting for Hillary because stopping Trump is paramount. Trump cannot be allowed to happen.

-

August-17-16, 07:03 AM #128

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 3,184

Hell yeah! Tax and spend! Tax and spend!

Decades of building up a military and our infrastructure, schools, and the social safety net SUCK! YAY!

And yeah, Jill Stein is a loon. She's not qualified at all, Gary Johnson of the Libertarians is more qualified, but he's just as crazy.Last edited by dtowncitylover; August-17-16 at 07:08 AM.

-

August-17-16, 07:19 AM #129

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2011

- Posts

- 5,067

-

August-17-16, 07:45 AM #130

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2012

- Posts

- 8,854

-

August-17-16, 07:48 AM #131

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 11,862

How does taxing at an increasing higher level impact motivation? Productivity? Self sustainability? Considering that that the narrative of support is usually about access of someone elses money! Personally, I'd like to keep what little I am making. The struggling middle class are hurt the most by more taxing.

Beyond partisan politics: is it selfish to want to keep more of what you earn? Or should we just allow the government maw further access after which to regurgitate more of the services and relief we would otherwise self provide?

Is the 'happy' conclusion is that one ends up needing more government subsidies as a result of increased taxing, specifically income tax? So glad to have the government so near and dear.

Then the government [[ever efficient in how it uses our tax dollars) requires more revenue to provide such, so more tax funding needed. Your left with even less of your hard earned, already deflated dollar, sooo you need more things form the government to offset your smaller check?

Not to mention the number of those paying taxes over those not paying has a tipping point. Once the percentage of those taxed [[under the current law) drops too low? Then what? Greece?

Last edited by Zacha341; August-17-16 at 07:55 AM.

-

August-17-16, 07:56 AM #132

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2011

- Posts

- 5,067

Why is it a "moot point"? If you're paying very low taxes relative to everywhere else, the whole "tax and spend" accusation is kind of a joke. Neither party supports any broad-based tax increases anyways.

I see you follow wacky conspiracy websites. There is no "rigged election". That would be completely impossible, given the highly decentralized nature of primary voting. You would need to have thousands of officials in all 50 states + territories in some incredibly complicated conspiracy.

Back in the real world, we have two candidates, only one of which is sane. That's why this election will likely be a landslide.

-

August-17-16, 08:00 AM #133

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 11,862

Who's paying very low taxes in the USA? Not the rank and file and ever struggling middle class! And we're starting to question the use of our taxes, period - repub/ dem be darned! Perhaps it may seem less globally-minded, but when you see your check shrinking more and more and your ability to buy groceries impacted you're not thinking alot about taxing in France.

Last edited by Zacha341; August-17-16 at 02:57 PM.

-

August-17-16, 08:06 AM #134

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2012

- Posts

- 8,854

Last edited by Honky Tonk; August-17-16 at 08:08 AM.

-

August-17-16, 08:28 AM #135

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 3,184

-

August-17-16, 09:16 AM #136

DetroitYES Member

DetroitYES Member

- Join Date

- Aug 2012

- Posts

- 8,854

Shillary already spent $30 bil right out of the gate propping up the coal industry whom she chastised a year before. That's Ok, a slight tax increase, a little money laundering, and no one will notice.

Nope, I learned to read a long time ago, so I try to read more unbiased reporting then the bought-and-paid-for mass-media working for their masters. But since Obama told you it's absurd, well, then it must be true. You remember Obama, don't you? He ran against Shillary in 2008, then suddenly she backed out. Don't know why, that never gets you anywhere.

-

August-17-16, 10:43 AM #137

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 8,191

-

August-17-16, 11:31 AM #138

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2015

- Posts

- 1,416

-

August-17-16, 11:32 AM #139

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2011

- Posts

- 5,067

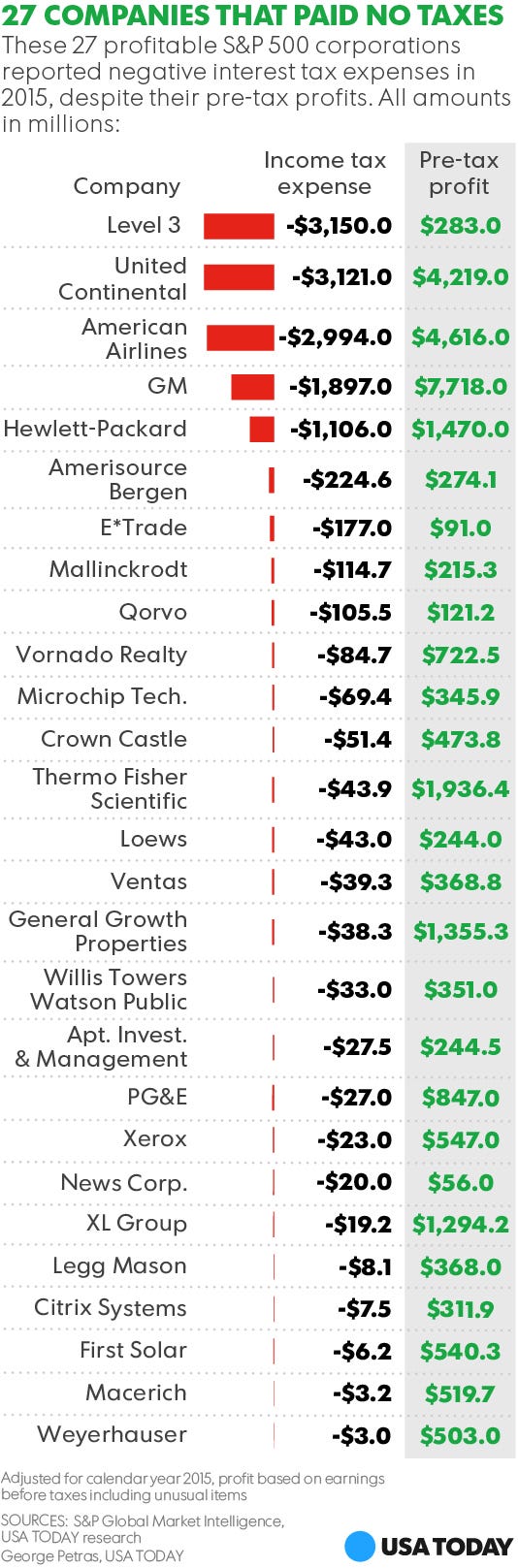

It isn't just corporations that pay low taxes.

In Europe, most middle class people pay a majority of their earnings in taxes. There are no filers paying >50% in the U.S., or really anywhere close to that percentage.

I'm a high earner, with significant assets, and don't have crazy high taxes. I have no problem with tax increases for higher earners. I don't want a Denmark-style system, but I don't think it's unreasonable for wealthy people to pay a bit more.

In the U.S., capital gains taxes are 15%, before deductions. Not an unreasonable share.Last edited by Bham1982; August-17-16 at 11:35 AM.

-

August-17-16, 11:35 AM #140

DetroitYES Member

DetroitYES Member

- Join Date

- Jul 2010

- Posts

- 5,276

Individual firms getting large tax rebates has little to do with whether the corporate tax rate itself is at a good level. Exceptions are usually useless for setting general policy.

That auto and airlines are near the top of the list, I would assume there is tax policy to help these industries compete. But who knows.

I think the general take on American corporate taxes is that the rate is too high, and the offsetting credits are also too high and only benefit big corporations over small ones.

-

August-17-16, 02:45 PM #141

DetroitYES Member

DetroitYES Member

- Join Date

- Jun 2009

- Posts

- 11,862

-

August-17-16, 05:55 PM #142

DetroitYES Member

DetroitYES Member

- Join Date

- Jul 2010

- Posts

- 5,276

Many want to say that Corporations are not People - see Citizens United. So in that case why should they pay taxes at all?

But more seriously, folks... shouldn't we really be taxing when real individuals receive the money?

Wonder where Trump really is on tax reform. He's making some good noises. And as someone who has seen the ugly side of tax law a lot, he probably has some strong opinions that are informed by real life experience -- not just dreaming about what making a profit is really like, as in say Obama or Bush.

-

August-17-16, 06:52 PM #143

DetroitYES Member

DetroitYES Member

- Join Date

- Mar 2009

- Posts

- 2,606

-

August-17-16, 07:57 PM #144

DetroitYES Member

DetroitYES Member

- Join Date

- Jul 2014

- Posts

- 1,054

-

August-17-16, 08:00 PM #145

DetroitYES Member

DetroitYES Member

- Join Date

- Jul 2014

- Posts

- 1,054

Because trickle-down economics never worked any of the times it was promised to have worked.-but I'm sorry, that's not about saving, per se, but that is more about the promise about how they were going to "flood us with more money" Thus, we should trust the cut-throat businessman [[who trampled on many and feels he never has to give an account of his failures, gaffes, or taxes even) to save us wee folk.

Last edited by G-DDT; August-17-16 at 08:03 PM.

Welcome to DetroitYES! Kindly Consider Turning Off Your Ad BlockingX

DetroitYES! is a free service that relies on revenue from ad display [regrettably] and donations. We notice that you are using an ad-blocking program that prevents us from earning revenue during your visit.

Ads are REMOVED for Members who donate to DetroitYES! [You must be logged in for ads to disappear]

Ads are REMOVED for Members who donate to DetroitYES! [You must be logged in for ads to disappear]

DONATE HERE »

And have Ads removed.

And have Ads removed.

Reply With Quote

Reply With Quote

Bookmarks